General fund has small surplus as city budget is approved

by Steven Felschundneff | steven@claremont-courier.com

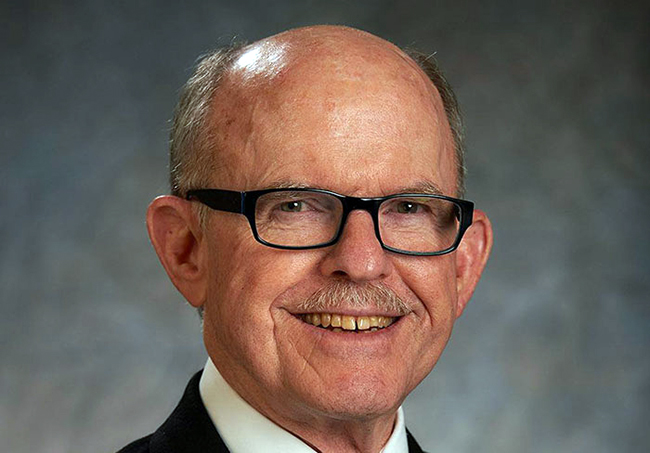

During the Claremont City Council meeting on Tuesday, City Manager Adam Pirrie presented the city’s final budget for the upcoming fiscal year with an expected general fund surplus of nearly half a million dollars.

During a special meeting earlier Tuesday, the council heard presentations from all department heads with details on each aspect of the 2021-22 budget, which was unanimously passed by the council later that evening.

Total city revenues for 2021-22 are projected to be $51,726,622, the largest chunk of which is the general fund at $28,387,628. The city projects $9,786357 in enterprise funds revenues, followed by $9,015,531 in special funds; $2,261,954 internal service funds; $1,729,102 successor agency; and $546,050 capital projects funds.

The biggest single source of general fund revenue is property taxes, with a budget for 2021-22 of $11,013,700, a three-percent increase. The next largest chunk of the pie is sales and use taxes, which is budgeted at $5,304,000, and represents a 26.83 percent increase over the previous year, which was highly impacted by the pandemic. Other large portions of the general fund include utility user taxes at $4,150,000; charges for services $1,584,232; and transit occupancy tax $1,200,000. Miscellaneous revenues are at $1,814,694.

The city’s total projected expenditures for the next fiscal year are $53,339,333, of which the general fund it the largest chunk at $26,193,144, followed by enterprise funds $11,189,991; special revenues funds $10,245,262; internal services $2,466,215; successor agency $1,729,102; and debt services $1,515,649.

Special funds are those which must be spent on a specific purpose such as those restricted by an outside agency such as Los Angeles County or the State of California or imposed by the city council.

Enterprise funds include transportation, cemetery, sewer and sanitation. Internal services provides motor fleet and technology services to the city. Successor agency funds are the result of the slow wind down of Claremont’s former redevelopment agency.

By far the largest portion of the general fund goes to the police department, which is projected to be $13,535,410 next fiscal year. That represents 50 percent of the general fund and about 25 percent of total city expenditures.

The rest of the general fund consists of community development, $3,118,896; administrative services, $2,326,198; human services, $2,214,996; general services, $2,201,889; community services, $1,919,829; and financial services $875,894.

Transfers out, at $1,694,967 is revenue the city moves from the general fund to pay for services such as landscape maintenance or the senior meal program. It also includes the landscape and lighting district. With transfers out added, the total general fund expenditures is $27,888,081.

The result is a general fund surplus of $499,547 which staff is recommending be allocated to the city’s general fund reserve which now has a balance of $5,891,568 or 21.3 percent of general fund expenditures. The reserve policy is to maintain 25 percent of expenditures in reserve and some councilmembers had expressed desire that any extra money go into that rainy day fund.

During the budget workshop in May, the surplus was projected to be larger at about $750,000 and during that time the city had indicated that $250,000 would be made to the city’s unfunded liability to CalPERS. But now the entire surplus will be going to the rainy day fund.

Many members of the public had asked that items removed from the 2020-21 budget would be restored with the general fund surplus. These include popular city organizations that the city has generally provided some funding toward including Claremont Heritage, Sustainable Claremont the Claremont Chamber of Commerce Friday Nights Live, Sunday library hours, homeless funding as well as other community-based organizations.

The city hopes that these programs may be fully funded with money from the American Recue Plan Act, otherwise know as President Biden’s stimulus bill. Staff will return to the city council with a plan for ARPA funds when guidance has been provided on eligible expenditures by the U.S. Treasury.

The council approved two additional items with the vote on the budget:

California constitution requires the city to calculate an appropriations limit adjusted annually by population growth and personal income. This year staff figured the limit at $45.5 million and budget proceeds from taxes at $30.6 million which is $14.9 million less that the limit.

The capital improvement program budget includes $2.2 million in street resurfacing projects, and in the interest of protecting those projects, the engineering division has proposed a street cut moratorium which would prohibit cutting or opening recently resurfaced streets for five years. The moratorium provides exceptions for emergency circumstances.

0 Comments