Is now a safe time to buy stocks and bonds?

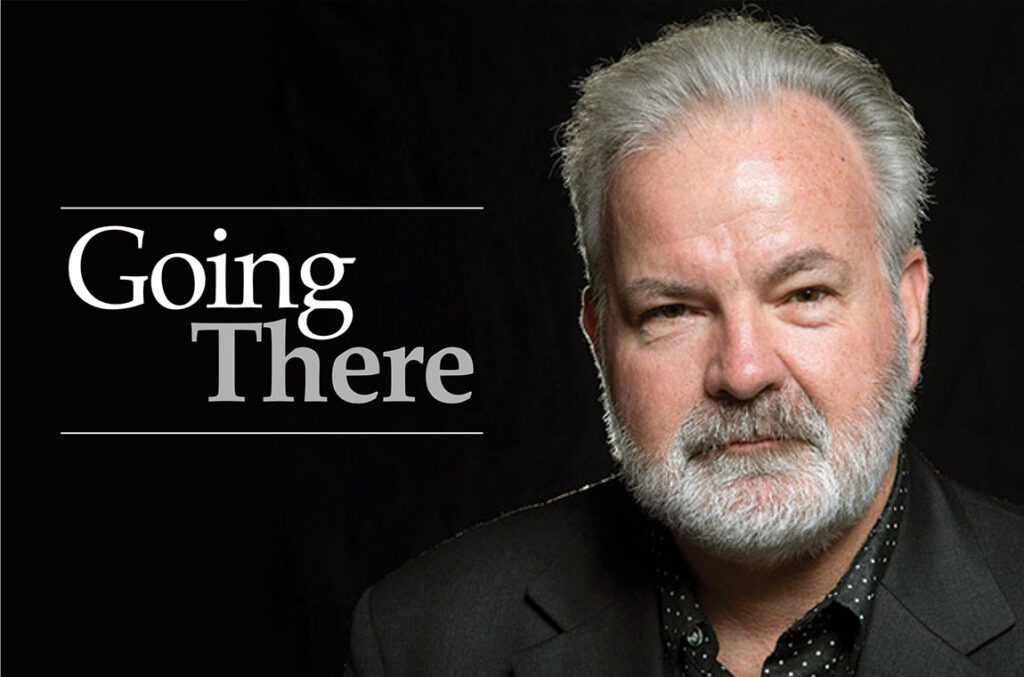

by Donald Gould

Frequently we encounter a client who has a substantial cash balance and wants to get it invested for the long term, but is unsure about when to enter the financial markets. The cash might be from an inheritance, the sale of a home or business, or simply accumulated savings. For many, today’s painfully low interest rates create more urgency to seek investments with better returns. At the same time, with stock and bond markets at all-time highs, investing right now can seem daunting.

Is now a safe time to buy stocks and bonds? The question reminds us of the famous lines from Mark Twain’s Pudd’nhead Wilson: “October: This is one of the peculiarly dangerous months to speculate in stocks. The others are July, January, September, April, November, May, March, June, December, August and February.”

Twain had it right—markets are inherently unpredictable in the short run. That’s what makes the entry decision agonizing. We see two primary approaches to solving the problem. Which one is best depends on the psychology of the individual investor.

Approach one: Invest it all and don’t look back

Stocks and bonds unquestionably have higher long-term expected rates of return than cash. This is the compensation investors expect for accepting the greater variability of these assets’ returns, as compared to cash. From 1926-2020, one dollar invested in U.S. large cap stocks grew to a whopping 496 times the accumulated value of the same dollar invested in interest-bearing cash instruments. Even a U.S. bond portfolio would have reached an end value more than eight times higher than cash.

Like Twain, we take as a given that no one knows the near-term direction of financial markets. Deferring entry in hopes of buying at a lower price later might—through dumb luck—result in better performance, but cannot be expected to improve performance. In fact, the opposite is true. Because the long-term trend of risk assets (stocks and bonds) is upward, deferral of implementation only delays the investor’s participation in these assets’ superior long-term trend.

Putting off investing now with the aim of getting a better deal down the road is itself an investment decision. The investor has passively decided to own cash, the asset with both the lowest risk and lowest expected return.

If you decide to play the odds and invest the whole amount at one time, we advise the following: (1) determine your investment strategy and asset allocation across stocks, bonds, cash, and other assets, taking into account both your objectives and tolerance for risk; (2) put the whole amount to work; and, (3) don’t look back.

However, investing it all and then not looking back may be more easily said than done, and it is not necessarily the right course for everyone.

Approach two: Staged implementation over time

While Approach 1 may be best from a “textbook” standpoint, investing a large sum all at once is emotionally challenging, not least because you will doubtless be second-guessed by yourself and maybe others if markets drop following your investment.

The saying, hindsight is 20/20, is particularly apt when it comes to investing. With the benefit of hindsight, right decisions seem obvious. At the time of the decision, however, things are never obvious. At any moment in time, market prices represent the weighted average of all investor views, meaning that some investors think prices are about right (or have no opinion), while the rest are split roughly evenly between those who think assets are “expensive” and those who see them as “cheap.”

Extending Twain’s observation, the market can easily nosedive right after a full implementation, making the move feel in retrospect like an imprudent plunge. If this worry predominates, then we recommend the client invest the portfolio in stages, at predetermined intervals. For example, a cash balance could be invested in four equal 25% portions over four calendar quarters. This reduces the risk of investing the whole portfolio at a recent market high, or more to the point, it reduces the risk of future regret over a “bad” timing decision.

By determining both the schedule and the dollar amount of each phase at the outset, the investor also avoids market timing, an impossible and hazardous pursuit.

As with so many investment questions, the answer to whether to invest a large sum all at once or in stages is, it depends. Consider your temperament and how you weigh the probability of a better outcome against the risk of near-term regret. And then, as Nike says, just do it!

Don Gould is president and chief investment officer of Gould Asset Management of Claremont.

0 Comments