Inventory, interest rates in standoff: Claremont home prices down, but stable

by Steven Felschundneff | steven@claremont-courier.com

Last spring Claremont’s real estate market was running pretty hot. Fueled by scant inventory, competitive interest rates and all-cash buyers, bidding wars were the norm. Now that interest rates have risen significantly, one would imagine prices would come down to earth, but that hasn’t happened.

“We are currently experiencing low inventory, there is not much for anyone to sell, so when there is a property for sale there is a lot of competition,” said Paul Steffen, owner broker at Wheeler Steffen Sotheby’s International Realty.

Literally pulled in opposite directions, the local market is in a state of détente. The competition sparked by too few homes has been neatly offset by the spike in interest rates that makes pricey homes even less affordable.

“Those two factors balancing against each other has stabilized the price of real estate,” Steffen said.

A well-priced Claremont home still sells fairly quickly and, generally speaking, with few price accommodations from the seller. But sellers have had to adjust too. Gone are the days when owners could expect to see double digit jumps in the value of their home year after year.

The median priced single family home in Claremont is currently $881,000, which is off by 11% from its peak last year but remains fairly expensive for the region. Homes stay on the market for a median of just 15 days and only 16% of active listings have reduced prices.

With mortgage interest rates hovering around 7.2%, it’s harder for potential buyers to qualify for Claremont’s median-priced home. A 30-year fixed rate mortgage on a $881,000 house with a 20% down payment of $176,200 works out to a monthly payment of $4,787 for principal and interest only. Two years ago when interest rates were closer to 3.5%, the payment on the same priced home with the same down payment would have been just $3,165.

“It’s very difficult for first-time home buyers and people moving into Claremont to compete,” Steffen said. “It is really tough, and cash is still king, because people with cash don’t have to worry about the cost of [borrowing] money.”

In March, 27 homes of all types sold in Claremont. The most expensive was a $1.78 million, 4,500 square-foot home on Amundsen Branch in north Claremont. The most affordable was a 1,180 square-foot condo on Mansfield Drive with a price tag of $460,000. The least expensive single family home was a four-bedroom, two-bath property in the 400 block of Oakdale Drive that fetched $625,000.

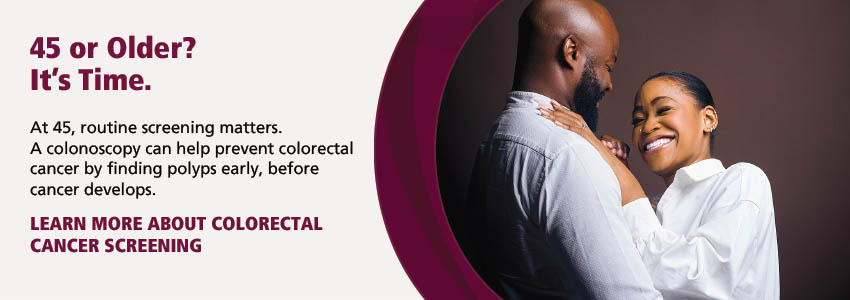

Higher interest rates have cooled Claremont’s once red hot real estate market, but price have not fallen much due in part to scant inventory. Seen above a neighborhood of large single family homes adjacent to Padua Avenue north of Baseline Road. Courier photo Peter Weinberger

“The other thing that is causing low inventory is that so many people refinanced at those wonderful 2.5% to 3% rates, so they really aren’t in a position to sell their homes and go buy something else at the higher interest rate,” Steffen said. “A lot of people are locked into their homes now until interest rates come down somewhere reasonable. Around 4.5% to 5% people will start selling their homes again then.”

The price of the average rental in the Inland Empire continues to climb, with the Riverside, San Bernardino and Ontario region posting the eighth highest price gains in the nation, at 7.3% year over year, according to data from Rent.com. Contrast that with the Los Angeles, Anaheim, and Long Beach region, which seems to have topped out with a modest increase of just 1.35% over the same period.

“We compare rent prices across bedroom types to determine which of the country’s most populated metros are becoming more affordable or more expensive for renters,” according to the report.

The median U.S. home price fell 3.3% in March to $400,528, the largest year over year drop since 2012, according to a report from the online real estate marketing firm Redfin.

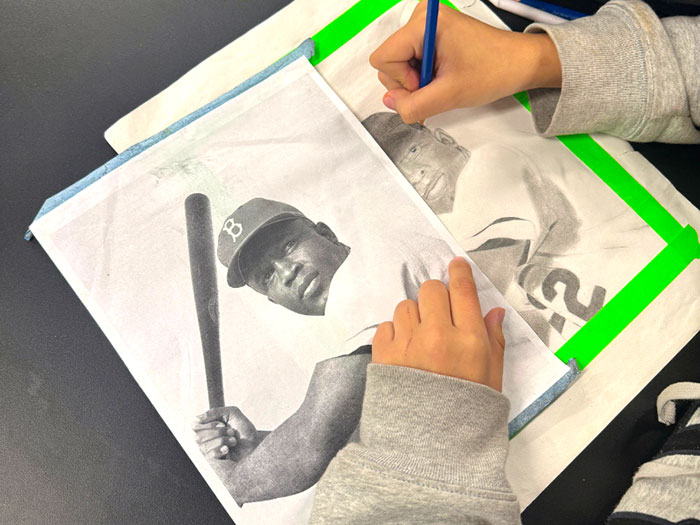

The median price for a single family home in Claremont has fallen 11% from last year’s peak to $881,000, but low inventory means homes sell quickly, an average of just two weeks. Courier photo/Peter Weinberger

“Pandemic boomtowns and pricey coastal markets, including Austin and San Jose, saw among the largest price declines. In many more affordable areas, prices continued to climb,” according to the report.

“New listings of U.S. homes for sale dropped 25% from a year earlier during the four weeks ending April 9, continuing an eight-month streak of double-digit declines,” Redfin’s Dana Anderson said. “People are reluctant to sell because they don’t want to give up their low mortgage rate, it’s hard to find another home to buy, and many Americans recently moved.”

Steffen says he is less optimistic than some other local brokers about the state of Claremont’s commercial real estate, in particular the Village.

“I am seeing a lot of vacancies down in the Village and a lot of it has to do with retail, which is just impossible nowadays,” Steffen said. “People buy online. They got in that habit during Covid. Everyone just sits at home and orders. If they do go into a store, they are often looking for ideas and they want to see [the product] and touch it. Then they walk outside the store and order it on their phone, leaving the retailer basically as an unpaid showroom.”

He sees the diversity of retail businesses in downtown Claremont disappearing and fears the Village will become a sea of personal services such as nail and hair salons along with restaurants.

“Because you can’t [dine out] online, although Door Dash is beginning to kill that too,” Steffen said.

0 Comments