‘Big beautiful bill’ impacts Claremont Colleges

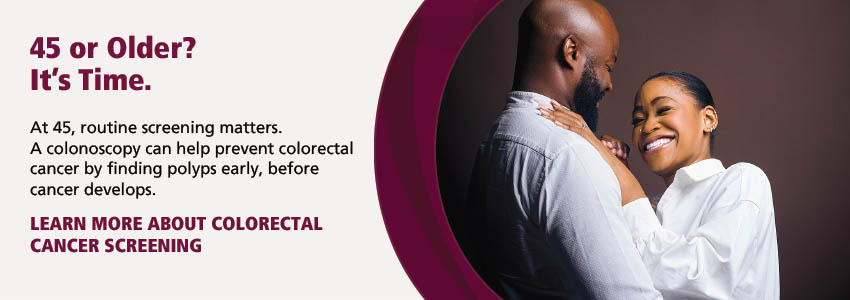

President Trump’s “One Big Beautiful Bill Act” brings sweeping changes to federal education policy, with varied impacts on the Claremont Colleges based on their endowments, student aid programs, and graduate earnings. Photo/courtesy of the Claremont Colleges

by Madeleine Farr | Special to the Courier

President Donald Trump’s federal legislation, the “One Big Beautiful Bill Act,” will impact colleges and universities across the country, including the Claremont Colleges; given distinctions within the consortium, however, each college will face varying consequences.

The legislation, which Trump signed into law July 4, makes sweeping changes to the entire federal budget. Pomona College’s President’s Office has published regular messages to the college community at pomona.edu/administration, most recently on Wednesday.

Some 5C administrations have commented on the bill publicly, highlighting key sections about changes to endowment taxes, student loan and aid programs, and Pell Grant eligibility criteria. Section E under Title VIII in the bill, of summary of which is viewable at acenet.edu/Documents, search “big beautiful bill,” also implements a new policy that enforces collegiate “accountability” based on graduate earnings.

Amid myriad policies that will likely strain finances for the Colleges, the bill alleviates some stress regarding endowment taxes, according to Pomona President Gabi Star’s July 16 statement posted at pomona.edu/administration, viewable by clicking “office of the president,” and “statements.”

Previously, higher education institutions faced a 1.4% flat endowment tax. The “big beautiful bill” instead presents a tiered model in which schools pay taxes proportionate to their endowment-per-capita. This model only applies to schools with more than 3,000 tuition-paying students, thus exempting all of the Claremont Colleges.

According to Starr, this will promote Pomona’s investment in financial aid. Under the previous flat tax model introduced in 2017, Starr wrote, “the cost to Pomona totaled more than $16 million, which is roughly equivalent to 184 full student scholarships.”

In a July 10 email to the Pitzer College community, President Strom Thacker also highlighted the increase in endowment tax for larger colleges and Pitzer’s subsequent exclusion.

“We continue to monitor closely the extent to which larger and wealthier institutions alter their enrollment strategies in response to these and other changes, which could have indirect, downstream effects on smaller institutions,” Thacker wrote.

He also noted that cuts to Medicaid and other services, while not targeting Pitzer or the Claremont Colleges institutionally, “could place additional strain on low-income students and families, as well as state higher education budgets, with potential implications for private higher education.”

The Claremont Colleges continue to collaborate as each school follows daily changes to the political and economic landscape. Pitzer College will also maintain collaboration with the American Association of Colleges and Universities and the American Council on Education, according to Thacker.

While the Claremont Colleges have not explicitly mentioned their involvement with American Association of Colleges and Universities and the American Council on Education, they all hold memberships with the organizations (as do hundreds of public and private colleges nationwide).

The American Council on Education Division of Government Relations and National Engagement published a reporton July 10, also viewable at acenet.edu/Documents, search “big beautiful bill,” that summarizes portions of the bill impacting institutions of higher education.

Many students across the Claremont Colleges will be impacted by the bill’s changes to the Pell Grant, a federal aid program designed to help students who demonstrate financial need pay for college. Pell Grants are not loans — they do not need to be repaid.

Trump’s bill places new restrictions on Pell Grants, which may impact need-blind admissions policies embraced by multiple Claremont schools. If a student’s aid equals or exceeds the cost of attendance, they may lose Pell eligibility.

“We are assessing the extent to which new formulas might affect Pell access for some students, especially those with complex financial aid packages that include non-federal scholarships or institutional support,” Thacker wrote.

The “big beautiful bill” also establishes an accountability framework for institutions based on graduate earnings. Colleges risk losing federal loans if their graduates’ mean income falls below a given baseline, which is determined differently for undergraduate and graduate programs. For example, if Scripps College graduates earn less on average than their similarly-aged counterparts with only a high school diploma (this is assessed as the four years post-graduation), the school could lose access to federal student loans.

As each Claremont College, shaped by distinct academic strengths and career pipelines, produces different post-grad income averages, this part of the legislation may sharpen the divide between schools whose graduates typically enter high-paying industries and those that prioritize paths with less financial return but strong social impact.

Communications offices at Pomona, Claremont McKenna, and Harvey Mudd Colleges did not respond for comment.

Senior Communications Manager at Scripps College Emily Peters shared the following on behalf of President Amy Marcus-Newhall: “We share our community’s concern about how the passing of the federal reconciliation bill and other legislative changes will impact Scripps College’s students, families, and community members. We are committed to delivering a rigorous and supportive academic experience in alignment with our mission, and continue to monitor, work with our peers and advocacy groups, and develop strategies to address the changes.”

0 Comments