City Council approves 2024-2026 budget

(L-R) Claremont City Manager Adam Pirrie, City Council members Jed Leano and Ed Reece at the June 11 council meeting. Courier photo/Andrew Alonzo

By Andrew Alonzo | aalonzo@claremont-courier.com

Last week’s Claremont City Council meeting kicked off with a special session regarding the 2024-2026 proposed operating and capital improvement program budget, which the council later approved unanimously during its regular meeting.

The budget approval follows an online survey that received some 800 responses, community focus groups, and council workshops that helped shape the council’s 2024-2026 priorities and objectives.

In April, the council reaffirmed its seven priorities for 2024-2026: preserving the city’s natural, cultural and historic resources; maintaining financial stability; investing in the maintenance and improvement of local infrastructure; ensuring safety through community-based policing and emergency preparedness; increasing neighborhood livability and expanding business opportunities; promoting community engagement through transparency and communication; and developing anti-racist and anti-discrimination policies as well as a plan to achieve community and organizational diversity, equity and inclusion.

City Manager Adam Pirrie wrote in a staff report the ratified fiscal year budgets include “the allocation of resources to achieve the objectives identified by the City Council during priorities setting process.”

The staff report also explained that the budget includes increased discretionary payments to the California Public Employees’ Retirement System.

“It’s been our practice over the years to include additional discretionary payments to CalPERS to pay down the unfunded liabilities on our pension plans,” Pirrie said. “In our recent history, that amount has been $250,000 per year. In recognition of the fact that we recently paid off the outstanding balance on our pension obligation bonds, we’ve increased those additional discretionary payments to $600,000 a year for the next two years.”

Pirrie said the general fund budgets were “balanced,” meaning revenues collected in each of the next two fiscal years are sufficient to cover city expenditures during that time.

“I am proud to present a balanced budget that not only meets the operational needs of the City, but also sets aside funding to address long-term pension liabilities,” Pirrie wrote in his budget message. “The 2024-26 budget reflects a stability in the City’s revenues, marking a successful negotiation of the effects of the COVID-19 pandemic with minimal impacts to service levels to the community. With stabilized, ongoing sources of revenue, the City is in a position to continue to fund the wide range of programs and services that the City of Claremont is known for.”

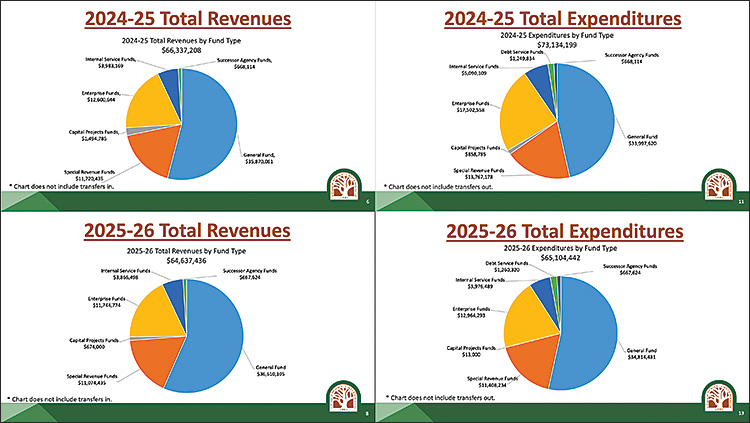

Revenues

Total revenue for 2024-2025 is projected at $66,337,208, with 53% of that figure, $35.8 million, coming from general fund revenue. Other revenues include $12.6 million in enterprise funds, $11.7 million in special revenue funds, nearly $4 million in internal service funds, $1.4 million in capital projects funds, and $668,114 in successor agency funds. Transfers in were not factored in the projection.

Revenue for 2025-2026 came in slightly lower at $64,637,436, but still boasts a healthy general fund revenue of $36.6 million, with an additional $11.7 and $11 million in enterprise and special revenue funds, respectively, $3.8 million in internal service funds, and more than $660,000 in each of the capital projects and successor agency funds.

General fund revenue sits at about $35,870,061 for 2024-2025. That figure is comprised of sales, property, transient occupancy, franchise, business license, and utility taxes, as well as other fees from licenses, permits, fines, forfeitures, and intergovernmental revenues. Property tax is set to generate $13 million; sales and use tax, $8.5 million; and utility users tax, $5.1 million.

“The projection for sales tax revenue for 2024-25 is $8,570,000, an increase of $1,001,000 or 13.2 percent over the prior year’s budget,” Pirrie wrote. The increased revenue projection results from auto sales, pre-pandemic revenue recovery, and “the impact of the allocation of taxable online sales to the City via the County pool from sales by online retailers such as Amazon,” Pirrie added. “This increase in revenues from online sales is the result of changes in State law [Assembly Bill 147] that require online retailers to collect and remit sales tax for purchases shipped to California.”

The 2025-2026 general fund is projected at $36,610,105, and will again see significant contributions from property, sales, and utility taxes — $13.5 million, $8.7 million, and $5.2 million, respectively.

“Budgeted sales tax revenues consist of two components: (1) sales tax generated from taxable sales in Claremont and (2) Proposition 172 revenues, which are State sales tax collections distributed to cities and counties to fund public safety services,” Pirrie wrote. “Other General Fund revenues are expected to see moderate growth over the next two years. In developing estimates for revenues, the staff has taken into account current economic conditions in making projections for 2024-25 and 2025-26.”

Costs

Department heads broke down funding, goals and work plans for the upcoming fiscal years, much of which will be fueled by the general fund, in order to achieve the city’s seven priorities.

At $35.8 million, general fund expenditures next fiscal year include $16.1 million for police, $4.4 million for community development, $4.1 million for general services, $2.9 million each for recreation and human services and administrative services, $2.3 million for community services, $1.8 million for transfers out, and $999,759 for financial services.

In the 2025-2026 fiscal year, the $36.6 million general fund is expected pay out $16.7 million to police, $4.4 million for community development, $4.3 million for general services, just over $3 million for recreation and human services as well as administrative services, $2.1 million for community services, $1.8 million for transfers out, and $1 million for financial services.

Total expenditures for 2024-2025 are projected to be $73,134,199, with projected revenue at $66,337,208. Council member Ed Reece requested an explanation for the multimillion-dollar difference.

“Included in the first year of the budget is an $8.2 million dollars in capital improvement program expenses that utilize accumulated fund balance to complete capital improvement projects,” Pirrie replied. “It’s not unusual for us to use special revenue and capital projects funds and even enterprise funds when it comes to the replacement of vehicles and equipment, to use accumulated fund balance to make expenditures or to plan for expenditures in a given year.”

The 2025-2026 total expenditures are slightly more balanced: $65,104,442 against projected revenues of $64,637,436.

In Pirrie’s budget message, he stated the 2024-2026 expenditures factor in upcoming capital improvement program costs, which stand at $8,226,045 in 2024-2025 and $3,915,000 in 2025-2026. Debt service costs of $1,654,087 in 2024-2025 and $1,660,948 in 2025-2026 were also factored into the crafting of the budget.

“The remaining operating expenditures of $63,254,066 in 2024-25 and $59,528,494 in 2025-26 fund a broad variety of services and programs,” Pirrie wrote.

Due to timing, public comment on the budget was pushed into the evening city council meeting. Claremont resident Ludd Trozpek asked what the city’s revenue from in-town cannabis delivery tax was since the passage of Measure CT in 2022, and then about the city’s 2019 structural deficit. Measure CT is a Claremont-based tax on marijuana sales and manufacturing.

Pirrie confirmed that while Measure CT projected the city would collect some $150,000 annually from cannabis deliveries, that ceiling has not been reached. The city manager then addressed Trozpek’s second question.

“We projected a $2.5 million-dollar structural deficit in 2018-2019,” Pirrie said. “In order to address that deficit when Measure CR [a 2019 sales tax increase] did not pass, we did make significant cuts to our budget.”

Pirrie added that in addition to budget cuts, the city experienced healthy growth in property tax revenues, ownership changes at auto dealerships which generated significant revenue, and an increase in sales tax dollars from online sales. Council member Jennifer Stark added American Rescue Plan Act funds also played a role in helping the city get out of the red.

Trozpek’s questions sparked a half-hour long discussion during which Stark floated an idea about proposing another city sales tax increase (Claremont’s current sales tax is 9.5%.).

“I think that it’s interesting to think that had CR passed, the $8 million or so in sales tax revenue would have looked more like $10 million potentially,” Stark said. Pirrie interjected to say the city would have been looking at between $11-$12 million in revenue in that scenario.

Stark argued that revenue from a potential sales tax increase could help fund homeless services, public safety issues, and park upkeep. She also recognized that any such proposal would be met with opposition.

“I see that as an opportunity that still is in front of us that I would like to … find a pathway to discuss that,” Stark said. In the end, the sales tax idea was shelved.

To see more details of the 2024-2026 budget, visit ci.claremont.ca.us/living/city-budget. To view Pirrie’s budget message, visit the link embedded on item 9 in the June 12 agenda at ci.claremont.ca.us.

The next Claremont City Council meeting is scheduled for Tuesday, June 25, where the body is expected to discuss Claremont’s sixth cycle housing element.

0 Comments