City listens to residents, lobbyists on cannabis businesses

Alex Cousins, right, management analyst with the City of Claremont, listens to Mark Ramos, president of UFCW Local 1428 labor union, during last week’s commercial cannabis listen and learn session at the Hughes Center. Courier photo/Steven Felschundneff

by Steven Felschundneff | steven@claremont-courier.com

Last year Claremont voters agreed to tax commercial cannabis, and now the city wants to know if its citizens actually want marijuana businesses to set up shop in town.

To gauge public sentiment the city held a “listen and learn” meeting last week, and based on the dozen or so people who spoke, Claremonters are evenly split between those who are cautiously open to the idea, and others who are excited to welcome marijuana businesses, particularly dispensaries.

Several cannabis industry lobbyists also spoke at the session, hoping to sway local leaders into crafting an ordinance that falls in line with what they say will lead to long term success and sustained tax revenue. More on that later.

Management analyst Alex Cousins opened the meeting with a presentation that included an overview of existing cannabis businesses in California, a brief history of marijuana regulations in Claremont, and an overview of Measure CT, which authorized the city to tax marijuana sales.

On January 24, the City Council established cannabis tax rates, setting the stage for eventually allowing the businesses to operate in town.

Under state law cannabis businesses cannot be within 600 feet of schools or daycare centers. In addition, city officials in Pomona asked that Claremont not allow these shops to operate within 1,000 feet of the two cities’ shared border. According to Cousins, when Pomona was drafting its commercial cannabis ordinance in 2019, Claremont officials requested a 1,000 foot buffer into Pomona, which was granted.

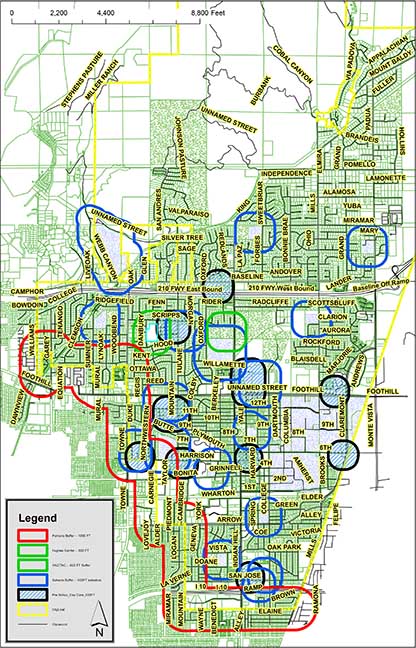

Cousins unveiled a map with broad areas marked off indicating buffers where cannabis businesses could not be located. A quick study of that map revealed few areas in town that were both outside these buffers and zoned for commercial use.

Based on the current map, cannabis businesses would be allowed in almost all of the Claremont Village, including the Packing House and all storefronts south of Bonita Avenue and east of Oberlin Drive. The proposed South Village development is also free and clear to have a dispensary.

Other areas where a cannabis business could operate include the Vons shopping center on Baseline Road, The Old School House on Foothill Boulevard, some of Peppertree Square at Arrow Highway and Indian Hill Boulevard, and the industrial complex in the 1400 block of Claremont Boulevard.

Claremont’s commercial district south of the 10 Freeway is too close to Pomona for cannabis businesses, while the Foothill Boulevard corridor is also largely blocked out because of proximity to schools or Pomona.

The city is early in its process of crafting an ordinance, and the City Council could at its discretion reduce or increase the buffer zones. It could also designate any part of town off limits to cannabis business, officials said.

Recently retired district attorney Jim Belna questioned the claim that Claremont could earn $300,000 annually by taxing retail sales of marijuana. At the 6% tax rate decided on by the council, the businesses would need to generate $5 million in annual sales, or $450 for each of the 11,000 households in the city.

“I find that to be unrealistic and my question is can you give us an example of a city of comparable size to Claremont which has allowed cannabis retail sales and has achieved several hundred thousand in revenue?” Belna asked.

Cousins responded there were similar cities earning that kind of revenue, but he did not have a list on hand Wednesday evening. However, this week he provided Belna, and the Courier, a list of five cities with populations of approximately 30,000 and projected fiscal year 2022/2023 cannabis tax revenues in line with Claremont’s estimate. Of those five, the lowest projection was $525,000 from Lemon Grove in San Diego County, which has a population of 27,413. The highest was $2.6 million from Goleta in Santa Barbara County which has a population of 32,855.

“If nothing else, I think its incumbent on the city right now to identify the locations they would find acceptable to have a marijuana dispensary,” Belna said.

Cousins replied that this was just the first of several listening sessions and that the city would use that input to establish which locations would be best suited for this type of business.

“It’s important to note Claremont isn’t in a bubble,” Cousins said. “We have a lot of people in surrounding cities that are interested in cannabis. People drive to Pomona to buy cannabis and we hear from residents that they are interested in something that is closer and something that is safer.”

Herman Janssen, a real estate professional who represents a cannabis business, said, “I’m here as citizen of Claremont and also recreational cannabis user myself. It would be really nice to have a dispensary in Claremont, I am a big fan of shopping in Claremont and keeping my tax dollars in Claremont. That would be a great way to support the bottom line here in Claremont and it would be a great miss if the city loses out on this opportunity.”

Longtime Claremont resident Murray Monroe agreed, saying he has advocated for marijuana businesses in Claremont since the concept was first considered in 2006. He said a dispensary could fill one of the many vacant storefronts in the Village and possibly increase business at existing stores.

Vickie Nobel said she would be interested in seeing a map that showed where the businesses could operate and expressed concern about the cannabis stores being unattractive.

“As a resident, we don’t want to be surprised at where they will be placed, but we also don’t want to be surprised at how they are going to look,” she said.

Mike Getlin, director of licensing and public affairs at Nectar, which has 47 cannabis stores in three states, praised the city for taking a thoughtful approach to crafting its ordinance and for engaging the community with the series of listening sessions.

“California is a very unique market because of the entrenched black market that exists everywhere, so the reality is once you open a recreational program in the city new people are not going to start consuming marijuana products. Fewer people will be consuming untested untaxed marijuana products and more will be shifting into retail stores,” he said.

He warned against adopting rules that are too strict about where a cannabis store can operate, noting the high overhead incumbent on theses operations requires steady foot traffic and being in an established retail area helps with stability.

“The proposed tax rates are really in line with a long term competitive stance which we like,” Getlin said. Relegating “businesses off of main drags has shown time and time again to be a major problem. So, it’s not just like a build it and they will come because people have entrenched purchasing habits that are directing revenue out of this city right now. And it will actually take work and time to claw that revenue back into its right place.”

0 Comments