City saves $157,000 with repurchase of old pension bonds

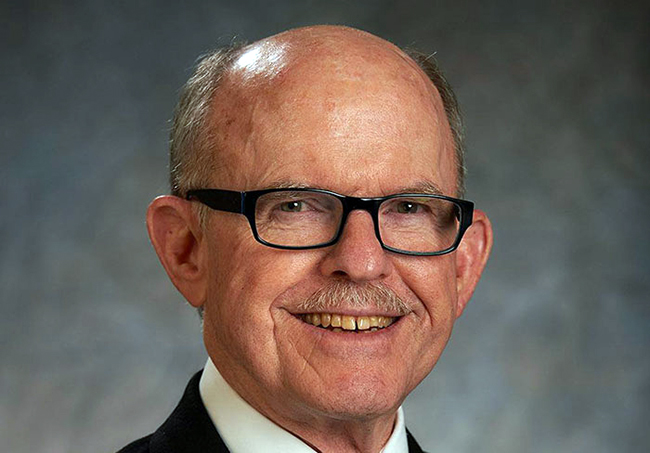

Claremont’s new Finance Director Jeremy Starkey will oversee the repurchase of $2 million in taxable pension obligation bonds, following the council’s recent approval of a repurchase agreement. Courier photo/Steven Felschundneff

by Steven Felschundneff | steven@claremont-courier.com

The Claremont City Council has authorized its new Finance Director Jeremy Starkey to repurchase taxable pension obligation bonds the city originally issued in 2006, after the holder of those bonds offered a discount.

The original issue was made in January 2006 for $6,060,000 as part of the city’s ongoing effort to pay down its unfunded liability to California Public Employees’ Retirement System for its employee pensions.

The outstanding principal of the bonds is now $2,030,000, with an interest rate of 5.18%. They are set to mature on June 1, 2027. However, the exclusive owner of the bonds, the German firm FMS Wertmanagement, has offered to sell the remaining bonds back to the city at a 10% discount.

“The Owner has offered to sell the Bonds back to the City for the discounted purchase price of 90 percent of their outstanding balance plus accrued interest,” read a staff report from Starkey, adding the move would save the city approximately $157,000.

A payment of $639,597, including principal and interest, is part of the budget for the current fiscal year. The finance department advises that an additional payment of $1,235,403 from the general fund would cover the bond repurchase plus an estimated $40,000 in transaction costs.

Those transaction costs include $20,000 to its repurchase agent, Stifel, Nicolaus & Company, $5,000 to Urban Futures, the city’s financial advisor, $7,500 to bond counsel Stradling Yocca Carlson & Rauth, and a contingency of $7,500 for “trustee or other miscellaneous costs.”

The early repayment will allow the city to avoid debt service payments of $1,629,299 over the next two and-a-half years, which will save the city approximately $130,000 in interest, according to Starkey.

During the November 14 council meeting Starkey said the city could reallocate the money already budgeted for payments on the bonds into direct payments to CalPers, essentially doubling down on addressing the unfunded liability.

0 Comments