County’s annual property valuation shows modest gains in Claremont

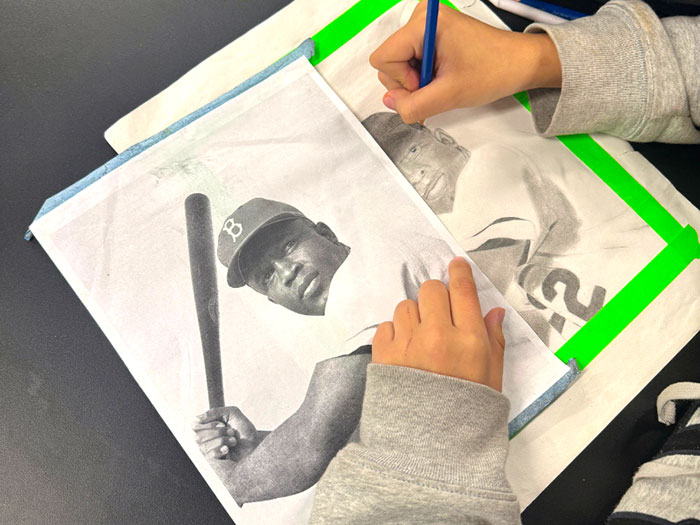

Courier photo/Peter Weinberger

By Jeff Prang | Special to the Courier

It’s that time of year again when my office undertakes its most important function of the fiscal year that lays the groundwork for the very property taxes that pay for our vital public services: the assessment roll. In fact, it’s a Constitutional mandate.

The roll for 2024 has been closed as of June 30 and it reflects growth for Claremont as well as the rest of Los Angeles County.

First off, let me say this comprehensive tally values more than 2.5 million real estate parcels in Los Angeles County and results in the very tax dollars that go to pay for vital public services, such as healthcare, police, fire, schools, and even librarians, to name just a few. As I mentioned, I am constitutionally mandated to close the roll by the end of the fiscal year on June 30. As a point of reference, my fiscal year runs from July 1 to June 30.

I am pleased to announce that the 2024 assessment roll has a total net value of $2.1 trillion, indicating the 14th consecutive year of growth. The 2024 roll also grew by $96.7 billion (or 4.8%) over 2023. That value places about $20 billion to be used for those public services I mentioned.

Claremont came in at $7.05 billion for taxable values in 2024, which is a 5.9% increase over last year. That includes 9,539 single-family homes, 285 apartment complexes, and 500 commercial-industrial parcels, for a grand total of 10,324 taxable properties. It’s a solid growth at $7.05 billion.

Some basics: the roll contains the assessed value of all real estate and business personal property in the county’s 88 cities, along with unincorporated areas. It also breaks down the number of single-family residential homes, apartments and commercial-industrial parcels.

This year’s roll comprises 2.39 million real estate parcels and business assessments countywide. That includes 1.89 million single-family homes, 250,000 apartment complexes, 248,000 commercial and industrial properties and more than 163,000 business property assessments.

Since the roll is the inventory for all taxable property in the county, it can provide some insight into the health of the real estate market. The roll is also driven in large measure by real property sales, which added $53 billion to the roll as compared with 2023; the Consumer Price Index adjustment mandated by Prop. 13 added an additional $39 billion; and new construction added $9 billion.

Finally, to say this has been a challenging couple of years is an understatement. The fact that property values continue to grow is certainly good news and testament to the viability of the region. A full list of assessment growth amounts and parcel counts for cities and unincorporated areas is available through my office at assessor.lacounty.gov.

Los Angeles County Assessor Jeff Prang has been in office since 2014.

0 Comments