Crystal balls: elusive and overrated

by Donald Gould

This first quarter of 2024 marks four years since the start of the Covid pandemic. Yes, it’s hard to believe, but it’s really been four years since an invisible virus upended our world. The pandemic’s onset and the subsequent performance of financial markets reinforce two points investors should always keep in mind.

First, the future is unknowable. On New Year’s Day 2020, hundreds of thousands thronged to the Rose Parade in Pasadena, and probably none could imagine a world in lockdown less than three months later.

Returning to our case in point, if your crystal ball had told you that in the U.S. alone the pandemic would cause an immediate loss of 25 million jobs, more than one million deaths, and stretch out two to three years, you probably would not have predicted very strong stock markets in three of the last four years or the highest inflation in decades. Yet, that’s what happened.

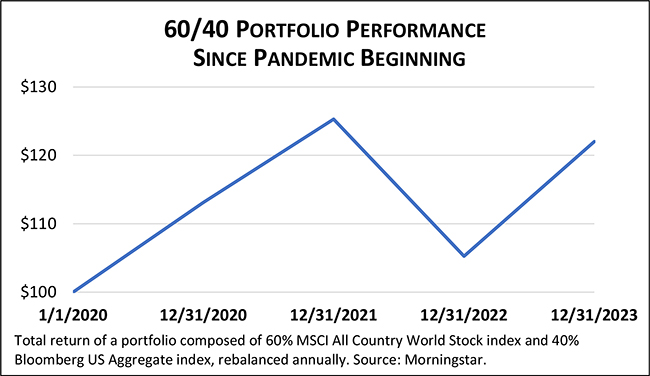

Our Rip Van Winkle investor who began a four-year nap on New Year’s Eve 2019 would have awakened this past New Year’s Eve (blissfully unaware of all the period’s turmoil) to find a balanced portfolio had compounded at a middle-of-the road 5% annual rate during the nap.

What a difference a year makes

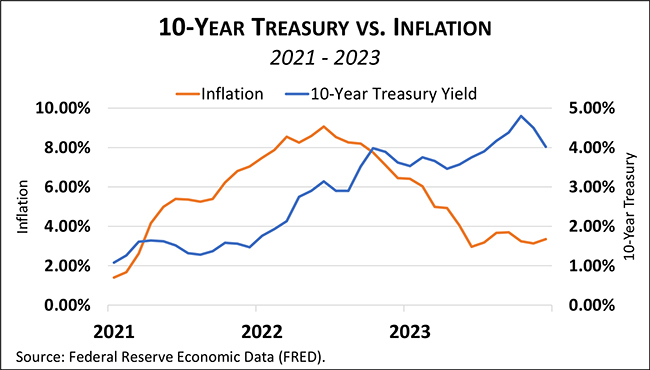

At this time a year ago, financial markets were licking their wounds after a historically bad 2022. Massive early pandemic government stimulus caused inflation to begin accelerating in early 2021. By mid-2021, central banks responded by initiating an 18-month series of interest rate hikes. Together, inflation and higher short-term rates pushed bond yields sharply higher through most of 2021 and 2022.

In 2022, the leading U.S. bond index delivered its worst return ever by a wide margin, losing about 13%. (Remember, rising interest rates push down the price of existing bonds.) Stocks fell even more in 2022, down about 18%. With both main asset classes plunging in 2022, balanced portfolios of stocks and bonds also turned in one of their poorest years on record.

Playing the long game

Go ahead and revel in 2023’s year-end statement values, especially after the trauma of 2022, but stay focused on your longer investment time horizon. It’s easy to feel as high today as we felt low a year ago, but fear and greed are the long-term investor’s twin nemeses. Huge market swings over the past four years provided numerous opportunities for overreaction and self-inflicted wounds — for example, selling stocks early in the pandemic or after 2022’s historic decline, either of which would have been bad moves.

To navigate these emotional swings, it’s key to have a long-term investment plan already in place before the storm hits. The year 2024 surely holds many more surprises, both in the news itself and how markets react to those headlines. Your plan, put in place in calmer times, can serve like a ship’s compass in a fog, helping you stay on the course you’ve set for yourself. For many, it’s also important to have a trusted friend or advisor who can help you counter any impulses to overreact.

Don Gould is president and chief investment officer of Gould Asset Management of Claremont.

0 Comments