The One Economic Number to Watch — Part 2

In this two-part article, I suggest that if you could only watch one economic indicator, it should be the interest rate on the 10-year U.S. Treasury Inflation-Protected Securities, or TIPS for short. The TIPS bond pays a return that is indexed to inflation. Both the principal and interest on the bond grow at the rate of inflation, making it a very interesting investment for those concerned about protecting the value of their portfolio from unanticipated inflation. More details on TIPS are contained in Part 1, published in last week’s Courier.

In Part 1, I focused on how the TIPS interest rate, together with the interest rate on standard Treasury bonds, gives us a good idea of consensus inflation expectations. This week, I will discuss how the TIPS yield also can capture: (1) an idea of the long-term outlook for economic growth, and (2) the current risk-free rate of return, against which all other investment returns are calibrated.

Check out part one of this series.

The “Real” interest rate

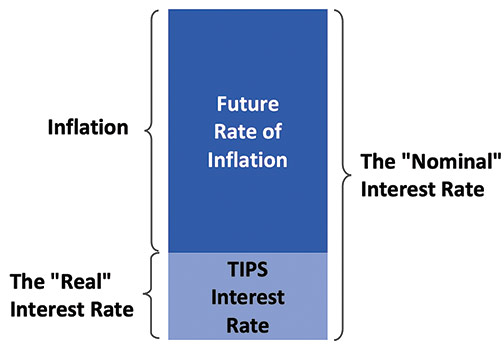

Economists talk about two kinds of interest rates, “nominal” and “real.” Nominal interest rates are the kind we’re used to talking about. A newly issued standard 10-year U.S. Treasury bond pays about 1.6% interest per year. That is its nominal interest rate. Its real interest rate is what you are left with after adjusting for inflation. The formula is very simple:

Real Interest Rate = Nominal Interest Rate minus Inflation Rate

Restated:

Nominal Interest Rate = Real Interest Rate plus Inflation Rate

The accompanying chart to the right illustrates these relationships.

As an example, if we expect 2.5% per year annual inflation over the next ten years, the real interest rate on the standard 10-year Treasury bond would be 1.6% minus 2.5%, or negative 0.9%. Sadly, that means the bond is expected to lose purchasing power over its life. (FYI, it’s much worse still for the garden variety bank deposit—with an interest rate effectively at zero, it can be expected to lose 2.5% of its purchasing power annually for years to come.)

As investors, ultimately we are concerned about the real rate of return. A positive real rate of return means we have preserved and even increased the purchasing power of a portfolio over time. You make long-term investments to accumulate assets that will one day be drawn on to meet your cost of daily living, for example, in retirement. Preserving purchasing power is of paramount importance if the assets are to deliver on that goal.

To illustrate why it is the real return that matters, we offer this question: when is a 4% return better than a 7% return? Answer: if the 4% return is achieved in a 1% inflation environment, it is superior to a 7% return that is accompanied by 5% inflation. In the first case, your purchasing power has grown by 3% (4% minus 1%), compared to only 2% (7% minus 5%) in the second case.

TIPS Rate as a Barometer of Economic Health

The real interest rate is hugely useful as a gauge of general economic health. Freed of the inflation component, the real interest rate reveals the most economically relevant measure of the cost of borrowing money, which in turn tells us a lot about how the economy is doing. When economic prospects are bright, businesses bid up the cost of money (the real interest rate) because there are many profitable opportunities for putting that money to work. As examples, the borrowed funds could be used to develop an improved product, build a new factory, or launch an advertising campaign.

The beauty of the TIPS interest rate is that it tells us the real interest rate, without having to estimate future inflation. The return on a TIPS bond is equal to its stated rate plus whatever inflation turns out to be. So, the stated interest rate on a TIPS bond is, by definition, the real interest rate at any moment in time.

The chart that ran in last week’s column shows the interest rate on the 10-year TIPS over the past five years. The rate has generally trended downward in the most recent 2-1/2 years, except for a brief spike early in the pandemic when capital markets experienced a momentary dislocation. The steady decline of the TIPS rate over time coincides with a general drop in the rate of economic growth in the U.S. and other developed economies. Watching the TIPS rate will tell you when markets’ view of future economic growth rates has changed, for better or worse.

TIPS rate as baseline for all investment returns

Generally, U.S. government bonds (including TIPS) are considered the lowest-risk investment available. Consequently, they provide a baseline for comparing the expected returns on all other investments. As you might assume, the incremental return we expect from investing in another asset—for example, stocks—is proportional to the amount of extra risk we must accept.

Over the past century, U.S. stocks have returned on average about 5% per year above U.S. government bonds, which in turn have returned about 2.5% per year over inflation. Thanks to the TIPS interest rate, we know that today, U.S. government bonds will return about 1% per year below inflation (yes, below) in coming years. If stocks continue to earn 5% per year above bonds (a big if, to be sure), then stocks will return on average only about 4% over inflation. That 4% real return is well below their historical 7.5% average real return.

This has major implications for investors. Historically, a balanced portfolio (say, 50% stocks, 50% bonds) returned on average about 5% per year above inflation. Given today’s very low (actually, negative) real interest rates, that same portfolio might return a meager 1.5% over inflation in coming years. The impact of this would fall most heavily on younger investors who are still early in the asset accumulation phase of life. Possible responses include working more years before retirement, taking more risk, or reducing what you spend now and/or in retirement. There are no easy answers.

If the 10-year TIPS rate rebounds to earlier levels, we would expect generally higher investment returns going forward. You can track the 10-year TIPS interest rate daily at https://www.treasury.gov/resource-center/data-chart-center/interest-rates/pages/TextView.aspx?data=realyield

Don Gould is president and chief investment officer of Gould Asset Management of Claremont.

Donald Gould

0 Comments