Council, city receive midyear budget update

by Steven Felschundneff | steven@claremont-courier.com

Claremont City Council heard a midyear update on the state of the city’s budget at its Tuesday meeting.

The budget report for the first two quarters of 2023-24 provides a status update on the city’s primary revenue and expenditure sources, with a focus on the general fund.

During the first half of the fiscal year the city’s funds are generally performing as expected and Claremont has received sufficient revenues to project that the full year budget estimates are “realistic and that the city in on track to meet or exceed those full year projections,” according to a staff report from Finance Director Jeremy Starkey.

Likewise, the money the city has spent through December 31 is “generally inline with expectations” of 50% of a full year worth of expenditures.

“At this point, staff expects that full-year expenditures will remain within budgeted constraints by the end of the fiscal year. Staff will continue to monitor expenditures through the remainder of the fiscal year for any adjustments in appropriations if necessary,” according to the staff report.

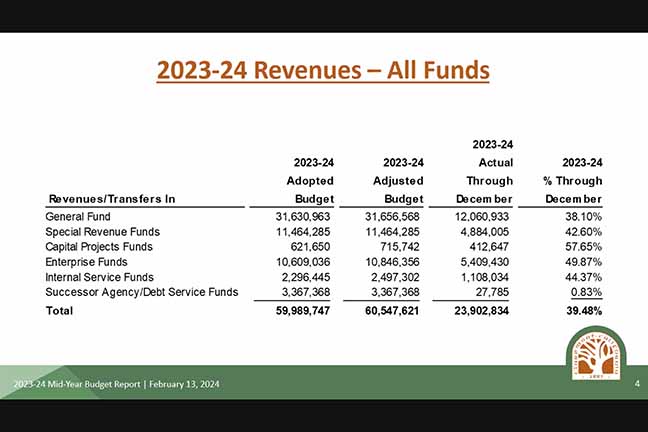

Last June the City Council adopted its operating and capital improvement budget that included $59,989,747 in revenue and transfers in from other funds. Since then, the finance staff has amended the revenue outlook to account for grant monies that have yet to be received, for an adjusted budget of $60,547,621.

At mid-year the city has received $23,902,834, or 39.48% of its total expected revenues for the entire year. According to the staff report, this is consistent with previous years’ budgets during which the bulk of key sources of money was remitted in the second half of the year, most notably property taxes, of which only $2,640,436, or 22.02% of a total $11,992,000, had been received by December 31. Also, the city has received just $2,856,386, or 37.74%, of a total $7,569,000 in expected sales taxes.

Image/courtesy of City of Claremont

Total expenditures were budgeted at $62,963,066. However, subsequent amendments for energy and other capital projects and equipment acquisitions as well as grants and carryovers of unspent funds from prior years have resulted in an adjusted total budget of $68,321,644.

At first appearance the difference between roughly $60 million in revenues and $68 million in expenditures points to an unbalanced budget, but the difference is from fund balances that existed at the beginning of the fiscal year.

“These beginning fund balances exist each fiscal year and allow the city to carry forward previous year’s appropriations that were unspent or make new one-time appropriations using the existing fund balances without additional revenues in the fiscal year,” Starkey said.

Expenditures and transfers out as of December 31 were $31,767,604, or 46.50% of the total budget.

The general fund represents the bulk of the city’s income with an adjusted annual budget of $31,656,568, of which $12,060,933, or 39%, has been received by midyear. In addition to property and sales taxes, other large sources of income include user utility taxes, transit occupancy taxes, and charges for services.

User utility taxes, which are tacked onto customers’ utility bills, totaled $2,086,942 through the second quarter, compared with $2,187,153 at mid-year 2022-23, a net loss of 4.58%. The lost revenue was mostly due to the City Council’s decision to pause collecting these taxes for a few months last year to offset the very high natural gas prices in the winter of 2023.

Transit occupancy taxes are paid by guests at Claremont hotels, a revenue source hit hard during the pandemic. The city has received $666,444 in TOT monies at the midpoint this year, which is $48,031 more than it collected at the same point last year, and is now more consistent with the TOT funds the city was collecting prior to 2020.

Charges for services, which includes rental fees for the city’s facilities, were $754,283 through the second quarter, slightly off of last year’s midpoint total of $783,780.

As of December 31, sources of revenue outside of the general fund include special revenue funds, $5,127,360; capital projects funds, $503,646; enterprise funds $4,762,799; internal service funds $1,652,127; and successor agency/debt service funds, $2,854,966.

General fund expenditures and transfers out were adjusted from the original budget of $31,140,874 to the adjusted budget of $32,856,907 to account for carryover of funds from the prior year for projects that were not completed, and additional appropriations approved by the council through the second quarter.

As of December 31, the city had spent $16,866,706, or 51.33% of the year end budget. The police department is the city’s largest general fund expenditure at $7,228,004 as of mid year, followed by general services at $4,340,195; community development at $1,578,123; human services at $1,219,568; administrative services at $1,154,271; community services at 883,917; and financial services at 462,628.

Most departments were at or just below the amount budgeted for midyear with the exception of general services, which came in $587,631 over, or 115% of the $3,752,564 budgeted for the entire year. According to Starkey’s staff report, the excess was primarily due to the city getting a bill in July for roughly $3.6 million to cover the general liability, workers’ compensation, earthquake, and property insurance deposits for the entire year. The extra half million was the result of some of the insurance premiums, in particular workers’ compensation, which were unexpectedly high.

0 Comments