A Simple New Year’s resolution: stop scammers from stealing your money

by Donald Gould

How about this for a New Year’s resolution: don’t let anyone steal your money.

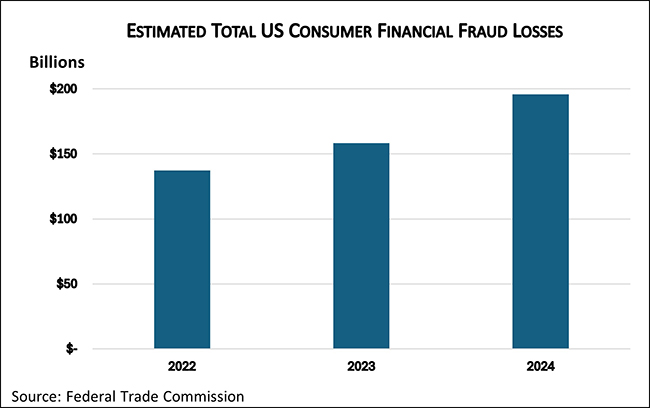

Simple as it sounds, avoiding financial scams gets more challenging by the day. Our electronic financial lives create a bonanza of opportunity for bad actors to separate us from our cash. The scams get ever more clever and sophisticated, with AI opening still new avenues of fraud. The Federal Trade Commission recently released a report estimating that American consumers lost a staggering $196 billion to financial fraud in 2024, a 43% increase in just the previous two years, with older adults losing nearly half the total. If you have been a victim of financial fraud, you are not alone.

A list of dos and don’ts for avoiding scams, while useful, is never quite enough because the landscape of financial fraud is always evolving. I believe a more helpful framework is to understand the psychology of these scams — how they look and feel — so you’ll recognize one when it crosses your path.

The scammer’s secret weapons

Signs that a stranger is trying to steal your money include:

Surprise – You receive a communication (a phone call, an email, a message popping up on your smartphone or tablet, a note on social media, etc.). It usually appears to be from someone authoritative (law enforcement, bank antifraud unit, Microsoft tech support, etc.), but sometimes from someone you know well. Either way, it’s a message you were not expecting when you woke up that morning.

Danger – The communication says you or someone you love is at risk. Your bank account has been compromised. Your grandchild has been arrested and needs bail money. Your computer is infected and exposing you to this or that risk. Your cousin’s passport and cellphone were stolen while traveling abroad and she needs cash to get back home, and so on.

Urgency – You are told time is of the essence. You must act quickly to cure the problem and avoid even greater troubles later.

Secrecy/Paranoia – The scammer implores you not to share this information with anyone. No one can be trusted. Or sharing will embarrass you or someone else.

Combining surprise, danger, urgency, and secrecy is intended to knock you off balance and create a sense of panic—sure ways to compromise your decision making.

Your secret weapon: slow down the process

If you spot any of these signs, the best way to avoid getting scammed is to slow down the entire process. First, just stop the interaction — hang up the phone, end the online chat, don’t reply to the email, ignore the threats. Instead, talk it over with someone you trust. That could be a close friend or relative, or it could be a professional you work with, such as a lawyer, accountant, or financial advisor.

If you find yourself about to do something that you could not have imagined doing when you woke up that morning — for example, buying retail store gift cards, wiring money to a third-party, investing in cryptocurrency, or withdrawing large sums of cash from your bank — again, stop and talk it over with someone you trust.

Consulting with a trusted friend or advisor slows down the process. Your fear and panic subside, you regain your balance, and you’re able to think more clearly. The second set of eyes will help you take a rational approach to addressing the “crisis.” Also, when you bring a second person into the picture, the scammer’s odds of success drop precipitously because now they must fool both you and your friend/advisor.

Taking charge

After regaining your equilibrium, if you still have nagging fears that those urgent warnings might be valid, then take charge of the situation. For example, if you’re worried your bank account might really have been compromised, then independently obtain your bank’s phone number and ask your friend/advisor to do the same. Make sure you get the same number. Then call your bank, explain the situation, and ask if anything is amiss with your account. Or visit a bank branch if convenient.

It is said that a fool and his money are soon parted, but countless unfoolish people daily are the victims of financial theft. With a little preparation, this year you can put the dunce cap on the scammers.

Don Gould is president and chief investment officer of financial advisory firm Gould Asset Management of Claremont.

0 Comments