City Council files long range financial plan

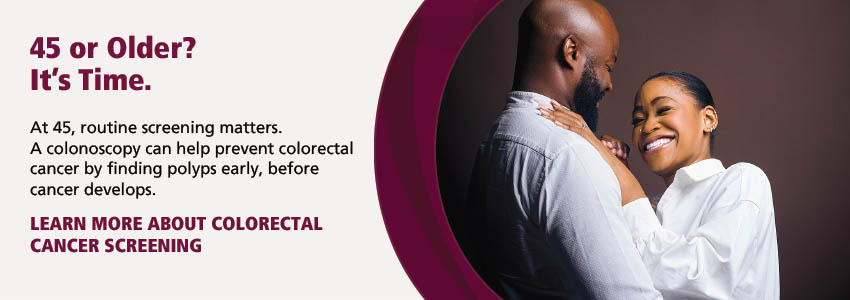

(L-R) Claremont City Council members Ed Reece, Jed Leano, and Jennifer Stark, Assemblymember Chris Holden, Claremont Mayor Sal Medina and Claremont Mayor Pro Tem Corey Calaycay at the September 24 council meeting. Courier photo/Andrew Alonzo

by Andrew Alonzo | aalonzo@claremont-courier.com

Claremont Financial Director Jeremy Starkey presented the city’s 2025-2034 long range financial plan at the City Council’s September 24 meeting.

Starkey said the plan aligns with the recently adopted council priority of maintaining financial stability and added that “by having a financial forecast tool that looks further into the future, the city can evaluate the financial stability further out.”

“The LRFP is a preliminary ten‐year forecast of the General Fund based on the most recent information available and includes preliminary estimates for the 2023‐24, at the point in time of release, for reference,” the document reads. “The recently adopted budgets for 2024‐25 and 2025‐26 are included as the first two years of the total ten years that the plan is comprised of. While the LRFP is anchored to the 2024‐26 Budget, this document itself is not a budget for the future years it portrays. It does however provide an overview of the City’s financial capacity based on assumptions for the next ten years, providing the City Council, management, and citizens a financial outlook beyond the biennial budget cycle. It can also serve as a planning tool for longer‐term priorities and needs.”

The document lists five objectives: it “allows council to develop a strategic vision,” “allows for informed decision-making,” “transparency and accountability,” “community engagement” and “risk management.”

Starkey highlighted key assumptions about growth in the city’s general fund revenues over the decade: 4% in property taxes, and 2% in sales taxes, transient occupancy taxes, utility user taxes, business license taxes and charges for services. Other revenues such as franchise taxes, permits, fines and forfeitures, city leases and interest earnings remain “relatively flat.”

General fund revenues are projected to rise, as are general fund expenditures. Assumptions include maintaining existing service and staff levels, which includes placeholder assumptions on salary and benefit cost increases.

“These cost changes include scheduled merit increases, a 2% increase in Workers Compensation rate changes, and assumptions for negotiated salary increases,” reads the document. “The City participates in the California Public Employees’ Retirement System (CalPERS) for all full‐time regular employees. The LRFP continues to fund the annual rate for the Employer’s share of the Normal Cost, the annual Unfunded Actuarial Accrued Liability (UAL) which is based on a 20‐year amortization schedule, and an additional discretionary [UAL] payment annually of $250,000. The Normal Cost rates and UAL payments are based on the latest CalPERS Actuarial Valuation for all retirement plans covering City employees. As of this report, the latest valuation was as of June 30, 2023.”

Additional expenditures include inflationary increases in services and supplies; debt service obligations; and annual transfers to the landscape and lighting district fund.

Another key assumption is if revenues meet or exceed expenditures, the city would be able to maintain its minimum reserve goal of 30% each year.

Starkey then highlighted the risks and opportunities not included in the LRFP: “Some risks to be aware of include an economic slowdown,” he said. “A slower economic growth rate can lead to reduce tax revenues. Elastic revenues, like sales tax can decline during economic downturns. A cooling of the housing market. The housing market cooling down with reduced housing sales can lead to lower property tax revenues on reassessments.”

Starkey listed additional development among opportunities not accounted for in the LRFP. “The LRFP assumes moderate or status quo development, but additional development within the city can provide one-time boosts in revenue,” he said.

Adding economic development such as new businesses coming to the city could bolster revenue. Another opportunity is the development of a new Residence Inn by Marriott hotel that will replace the former Knights Inn Motel at 721 S. Indian Hill Blvd. The project could increase transient occupancy tax revenue, Starkey said.

The LRFP is updated annually and presented each fall to the City Council. It is linked as an attachment under the administrative item portion of the agenda, viewable at ci.claremont.ca.us/government.

Chris Holden says farewell

California Assemblymember Chris Holden delivered warm remarks to the council. His presentation followed closely his June 29 op-ed, “Chris Holden: My 12 years in the Assembly,” viewable at a41.asmdc.org.

Holden’s 12-year run as Claremont’s representative in the 41st Assembly District ends December 2. In March, he failed to unseat incumbent Kathryn Barger in the race for Los Angeles County Board of Supervisors District 5.

Proposed water rate increase

Golden State Water Company’s Foothill District General Manager Ben Lewis presented to the council on proposed water rate increases. More information will appear in a future edition of the Courier.

0 Comments