IRS agents give CPP students a glimpse into their trade

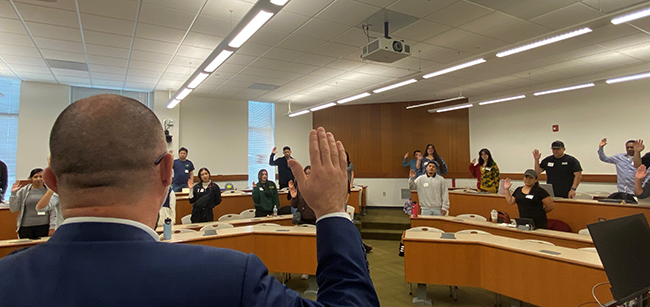

IRS Special Agent in Charge Tyler Hatcher honorarily swears Cal Poly Pomona students in as special agents for a day during a citizen academy workshop. Photo/courtesy of IRS Criminal Investigation, Los Angeles Field Office

Cal Poly Pomona students got a glimpse recently into of how IRS Criminal Investigation special agents conduct challenging investigations during a full-day criminal investigation simulation known as the citizen academy.

The 27 students were honorarily sworn in as special agents for a day and assigned to a mock case. The students then heard from a confidential informant who provided information on a potential tax crime and were afforded an opportunity to question him.

Citizen academies are an outreach tool IRS:CI uses to educate people from varied communities about the agency’s mission and the types of investigations it conducts. They take place across the country with students and professional groups such as tax preparers. Cal Poly’s citizen academy was hosted by its College of Business Administration.

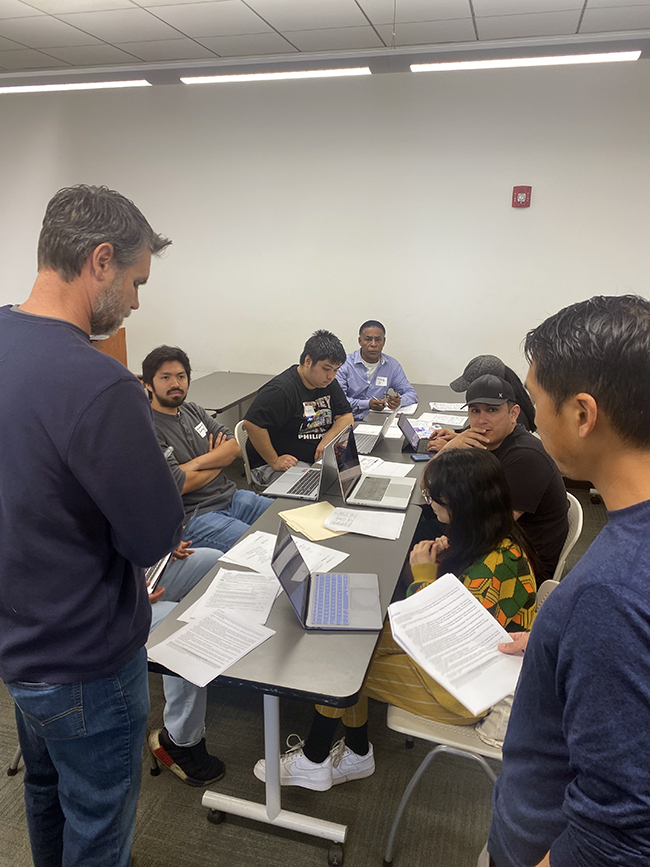

Students at Cal Poly Pomona’s College of Business Administration analyze data and information during a mock investigation as part of an IRS citizen academy workshop. Photo/courtesy of IRS Criminal Investigation, Los Angeles Field Office

“This is a unique program that allows us to provide people a glimpse into the life of our special agents and expose them to how we conduct incredibly complex financial crimes investigations,” said IRS:CI Special Agent in Charge Tyler Hatcher, of Los Angeles Field Office. “Cal Poly Pomona is a high-caliber school full of bright minds, and IRS:CI would be privileged to bring any of these students into our ranks one day.”

Students were eager to get to work.

“I’m really excited to learn more about forensic accounting and to meet others who might share some of the same interest in it,” said accounting major Gloria White. “Ultimately, I’m hoping to walk away with a bit of an understanding of a day in the life of forensic accounting.”

Roberto Santiago, also an accounting major, was hoping to learn more about a career interest. “One of my professors who also works for the IRS informed me about the citizen academy and I thought it might be a good way to learn about IRS:CI,” he said. “I intend to apply for position with IRS:CI after I graduate, and this seemed like a good opportunity to see what being a special agent might be like.”

Once assigned to breakout groups, students developed background on the known parties, analyzed tax return information, collected evidence, interviewed suspects and witnesses, conducted surveillance, and briefed a judge to obtain warrants before ultimately arresting their suspects.

The day concluded with a case recap, question and answer session, and a group photo.

Anyone interested in hosting a citizen academy can contact palapio@ci.irs.gov.

0 Comments