Collision course on US debt ceiling?

by Donald Gould | Special to the Courier

For weeks, the news media has been warning of an impending crisis if the two houses of Congress and the president are unable to reach agreement on raising the debt ceiling. Let’s look at what’s going on here and whether you should be losing sleep.

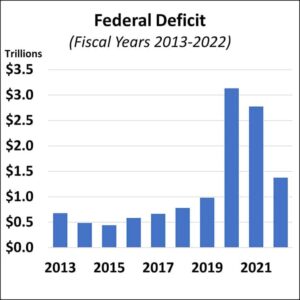

In this century, the United States has run a budget surplus exactly once, in 2001. More typically, we run an annual deficit, meaning the federal government spends more than it collects in taxes. During the pandemic years of 2020 and 2021, the deficit averaged nearly $3 trillion per year due to massive government stimulus, before dropping to $1.4 trillion last year. The government borrows to cover these annual shortfalls, issuing U.S. Treasury securities (bonds, notes, and bills) that range in maturity from just a few weeks to as long as 30 years.

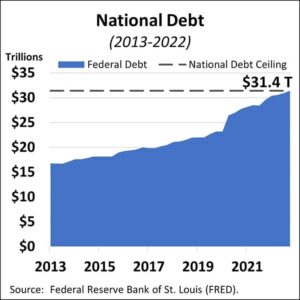

The national debt represents the cumulative effect of annual deficits, the total of the government’s outstanding borrowings. Existing law limits the national debt to the so-called “ceiling.” Once that ceiling is reached, the U.S. government cannot borrow more until the ceiling is raised through legislation. So, as we continue to run deficits, we must periodically raise the ceiling so that the government can continue to meet its obligations, like health care, Social Security, education, social welfare programs, defense, and many other budget items.

On January 19 the U.S. reached its current debt ceiling of $31.4 trillion. Since that time, the treasury, which pays the government’s bills, has used various accounting tricks to continue to meet the government’s obligations without technically breaching the ceiling. But that bag of tricks will be empty sometime this summer, when either a debt ceiling increase will be passed or the government will no longer be able to pay all its bills.

The challenge is ultimately political. Any faction that can block passage of a debt ceiling increase can make legislative demands in return for its agreement to support passage. Think of it as a game of political chicken: no one wants a default, and no one wants to blink.

It’s safe to say that any U.S. government failure to pay its bills would be hugely disruptive. Just the threat of such an outcome in 2011 led to major volatility in financial markets and the once unimaginable downgrade of the U.S. Treasury’s credit rating. We can’t say exactly what will happen if the government fails to pay its employees, contractors, recipients of social welfare programs, and/or the interest and principal on U.S. Treasury securities. But we do know it would be ugly.

For that reason, the general view is that a U.S. default is too “unthinkable” to happen. After all political points have been scored with target voters, surely the ceiling will be raised. The fear, however, is that with increasing political polarization in recent years, the fight over the debt ceiling could escalate beyond what either side wants. Unthinkable does not mean impossible.

I see three possible outcomes; first and perhaps least likely, Washington surprises us and reaches agreement well ahead of the summer deadline, and everyone breathes a sigh of relief. Second, and most likely, the warring factions hold tight past the 11th hour, sending financial markets and the media into a tizzy for at least a couple days, before finally reaching agreement. Third, the stalemate persists beyond the deadline, the government starts missing some payments, and markets and commerce experience serious disruption.

Should the unthinkable third scenario come to pass, the political pressure on all sides for quick resolution would be immense and probably irresistible, leading to a quick resolution, but not before causing substantial collective trauma and a major hit to America’s reputation.

Whatever course this takes, a year from today the debt ceiling clash should be well behind us. With that in mind, my advice is this: prepare yourself mentally for a crescendo of dire warnings over the next few months, and possibly even a real-life panic should we find ourselves in a period of default. But most important, at moments of stress remember that this too shall pass, and probably quickly.

In the meantime, don’t make any rash financial moves because someone says the sky is falling. Soon enough, the sky will be back in its usual spot overhead and the national debt will again be setting new records.

Don Gould is president and chief investment officer of Gould Asset Management of Claremont.

0 Comments