Ohtani’s $700 million contract: debunking the myths

Dodgers designated hitter Shohei Ohtani. Photo/by Mark J. Rebilas from USA TODAY Sports

by Donald Gould | Special to the Courier

On March 20, the Dodgers opened their 2024 campaign in Seoul, South Korea against the San Diego Padres. The game’s location is part of the effort by Major League Baseball to build international interest in the game. Fittingly, it featured baseball’s top global star, Shohei Ohtani, in his Dodgers debut.

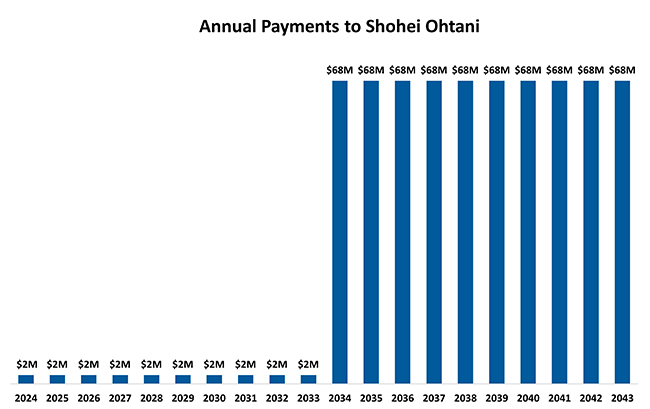

Much as I would enjoy talking baseball, this is a money column, so instead I’m going to review Ohtani’s jaw-dropping $700 million contract. The deal has captured the baseball world’s attention for both its size and unusual structure, with fully 97% ($680 million) of the contract to be paid out in the 10 years following Ohtani’s decade in a Dodgers jersey.

Much of the media’s breathless coverage of the contract is just plain wrong. Let’s review the myths and the facts.

Myth: Ohtani negotiated the largest contract in MLB history.

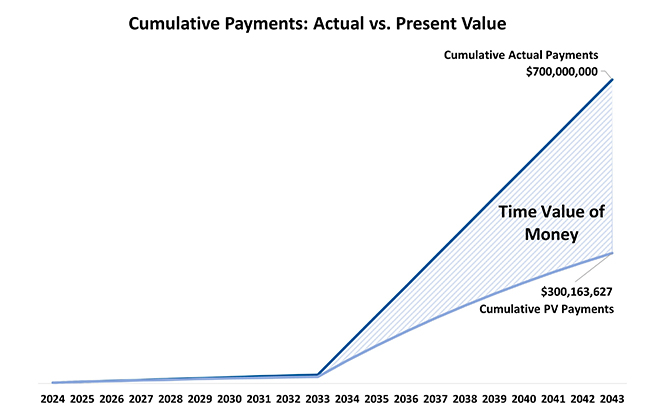

In dollar terms, $700 million exceeds all other contracts to date. But considering the time value of money and that most of the payouts are far in the future (2034-2043), the contract is not the largest. Case in point, Ohtani’s former Angels teammate, Mike Trout, garnered a richer contract in 2019. Wait, you say. How can Trout’s $426.5 million be worth more than Ohtani’s $700 million? Easy. Trout’s contract is paid over the first 12 years in roughly equal annual installments. Also, interest rates were much lower in 2019, reducing the discount applied to Trout’s future cash flows.

The upshot: the present value of Ohtani’s contract is about $300 million, compared to Trout’s $340 million in 2019. Adjusting for the inflation since 2019, Trout’s contract would be worth about $415 million in 2024 dollars!

Myth: Ohtani’s salary deferrals improve the Dodgers’ cash flow, enabling the team to buy better players during his playing career.

This myth has two parts. One is that the deferrals free up cash to spend on Ohtani’s teammates. The other is that the Dodgers will be spared some “luxury tax,” a league penalty imposed on teams whose payrolls exceed a set limit. Neither is true.

The Dodgers could have paid Ohtani $40 million in each of his 10 playing years and arrived at the same $300 million present value. Meanwhile, MLB is assigning a $46 million annual salary for those same 10 years, requiring the Dodgers to deposit that amount annually into an escrow account to meet the future payments owed Ohtani. Compared to the simple $40 million/year contract, the Dodgers are spending an extra $6 million annually, and that same $6 million is also added to their luxury tax calculation each year.

Fact: Ohtani left a lot of money on the table, and this (and not the deferrals per se) leaves the team with more to spend on other players.

As great as Mike Trout was in 2019, he falls short of Ohtani, one of the game’s top pitchers and hitters, and MLB’s biggest ever global sensation. Given the same deferrals, Ohtani could have commanded a $1 billion contract. Why didn’t he? My guess is he cares more about winning than money, and the money he left on the table is money he expects the Dodgers will use to upgrade the lineup. (Note: while the deferrals themselves don’t free up cash, accepting a lower contract value does.)

Fact: Ohtani’s deferrals save him $30 million in California income tax.

Imagine (as I do), that in game 7 of the 2033 World Series, Shohei throws the fall classic’s second ever perfect game, a 1-0 final decided by his walk-off homer with two outs in the bottom of the ninth. We can also predict that Mr. O, after a brief stop at Disneyland, will head straight up the I-15 to zero income tax Las Vegas. Establishing residency there will avoid California income tax entirely on the $680 million of deferred income.

The tax savings have a present value of roughly $30 million, recouping part of the contract money he left on the table — and at the expense of California’s tax collector, not the Dodgers.

Fact: Ohtani is taking most of the risk in this deal.

Shohei is taking some seriously big risks with the huge deferrals. For example, if inflation averages 3% instead of the 2% now forecast, the contract’s present value drops from $300 million to $265 million. With 5% inflation, the present value drops to $207 million, or by nearly a third. That’s not so impossible: inflation was running at 9% as recently as 2022.

A second risk is that the Dodgers can’t pay Ohtani the $680 million. That might sound farfetched, but much can happen in 20 years — a massive legal judgment against the team; a labor dispute that goes off the rails; a pandemic that shutters ballparks for years; or Congress ending MLB’s antitrust exemption. Use your imagination. In effect, Ohtani is accepting a $680 million IOU from the Dodgers. That’s a lot of eggs in one basket.

Ok, enough money talk. Play ball!

Don Gould is president and chief investment officer of Gould Asset Management of Claremont.

0 Comments